PCI-DSS Compliant Payments For a Leading FMCG Mobile Telephony Provider.

The client is an MVNO operating across the UK and Ireland, and operated by a large British FMCG retailer.

What the client needed?

The client operates its own MVNO mobile network, supporting over 5 million users. Their contact centre handles large volumes of payments by phone - a combination of one-off payments to account, and clearing or setting up payment plans for billing arrears.

Any organisation that processes payment card information falls under the scope of compliance for the Payment Card Industry’s Data Security Standard (PCI DSS). PCI DSS is one of the most complex industry standards and is constantly evolving. As a result, any contact centre that processes payment card data needs to be audited annually for PCI DSS compliance.

The client required a completely secure payment solution for Amazon Connect to ensure compliance with PCI-DSS whilst improving customer experience.

How we helped.

Contact Centre

Integrations

Contact Automation

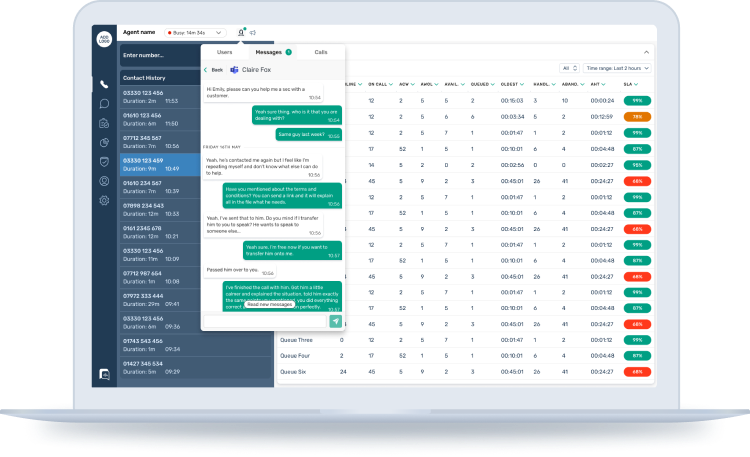

Mission Labs implemented our SmartPCI solution alongside the client’s existing Amazon Connect contact centre. SmartPCI is PCI DSS (level 1) certified in its own right and supports:

- Fully automated (self-service) IVR payments using Amazon Lex.

- Agent-initiated payments via SmartAgent.

- Agent-in-the-loop payments via SmartAgent.

- Fully automated (self-service) digital payments in Live chat and other channels.

With SmartPCI no cardholder data enters the physical contact centre environment, or the homeworker’s environment, so from a PCI DSS perspective the client’s area of scope is vastly reduced. This helps to reduce the mandatory annual audit costs, and provides the client with the flexibility to offer multiple convenient payment routes for its customers.

SmartPCI integrates directly with the client’s Payment Service Provider (PSP) APIs to capture card information in the cloud, encrypt it at source, and then communicate with the PSP to obtain a result. The result is then communicated back to the end user and to the contact centre agent, with back-office systems also automatically updated.

Why they chose Mission Labs.

Security.

As a large UK FMCG retailer, the client needed a development partner with a strong and proven track record of implementing technology solutions in highly secure environments.

Quality.

The client wanted to ensure PCI DSS compliance as the priority, but also wanted to improve customer service. Mission Labs expertise in customer experience transformation ensured they could deliver both.

Agility.

In the incredibly fast-moving retail & ecommerce space, today’s ideas are tomorrow’s norm. The client needed a partner that could build, launch and iterate quickly.

Ready to reimagine your contact centre?

We help to supercharge customer satisfaction, transform agent happiness and reduce your operating costs.